The Value Positioning Worksheet

The Value Positioning Sheet is a tool to use with sellers to help determine where they need to be

“positioned” compared to other homes on the market.

Here is an example of using the Value Positioning Sheet

in the Focus 1st Pricing System.

Follow along with the above sheet as we walk you through this example.

The first lines are for your customer information.

Step #1:

Pretend you are sitting with a buyer and about to select homes to look at.

You will load the buyer’s search criteria into the MLS system.

Where would this property show up in a search?

What categories or criteria would a buyer use for this type of property?

What other properties (similar to this) would a buyer would want to see?

Buyers tend to search based on three general criteria: Style, Location, and Price Range.

Once you have determined your search criteria, export your results into the Focus 1st Pricing System.

In looking at the competition through "buyers" eyes,

you may determine to do a different search than you would when pricing a home.

When pricing the property, the location is the most important factor.

When positioning your home, in most cases, the buyer is focused on a price range.

In most cases, when you search from the viewpoint of buyers eyes,

you would be focused on properties in a price range in a larger area or location.

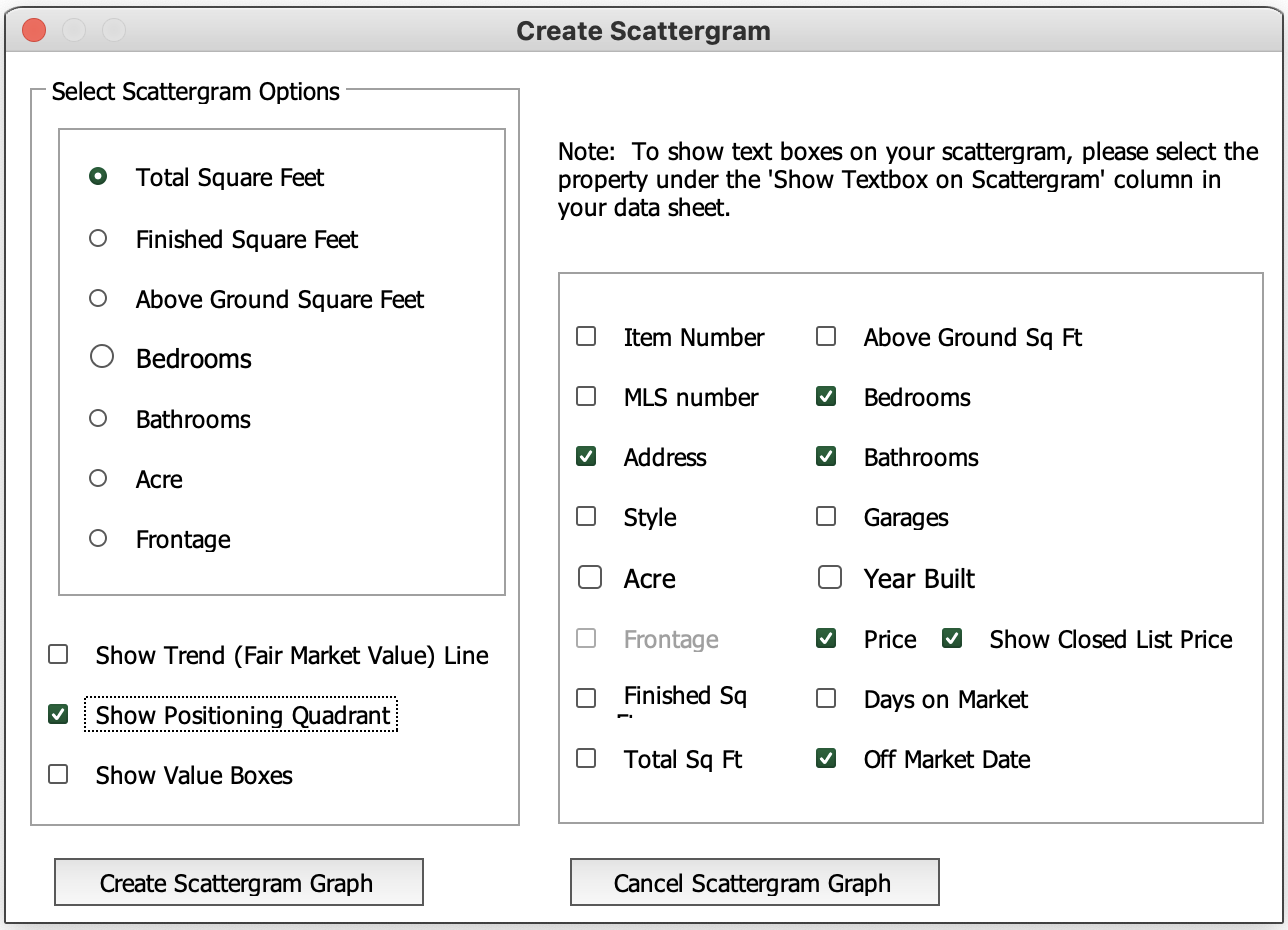

Once you've exported your data and read it into the Visual Pricing System,

go to the “Positioning“ tab and select the Value Positioning Sheet” tab.

It is filled out based on your search results.

Step #2:

In this example, in the last 12 months, 21

properties

have been sold.

This data is just filled in based on the exported data that you provided.

Step #3:

the number of homes sold (21) is divided by the length of time (12 months) to calculate the number of homes

sold over the period, or 21 / 12 (which is 1.75 or rounded off to 1.8

properties per month).

This calculation is the absorption rate.

Step #4:

In this example, there are currently 15 homes for sale that match the

criteria.

When we add your seller's house to the homes that are available on the market,

we increase that total number to 16 homes.

Step #5:

Assuming that the market continues to sell homes at the rate of 1.8 per month (the absorption rate),

how long will it take to sell the number of homes currently for sale (16 / 1.75 = 9.1).

This calculation s the month's supply.

Step #6:

With the number of homes selling at 1.8 (1.75) per month, and with there being 16 properties for sale,

the odds of your seller's homes selling within the next 30 days would be 1.8 / 16 =

11%.

This analysis assumes that there is a uniform rate of sales over the year

(in other words, it s based on the idea that each month there are 1.8 sales).

If you have a very seasonal market,

we suggest you use the Projected Pond to estimate the number of sales in the

upcoming months.

The seller may be concerned with their odds of selling in the next 30 days,

being only 11% (not very high).

However, they should be impressed that you can show them their odds with this level of precision.

At this stage, you should make two key points:

- “Most buyers do not buy homes based strictly on price.

They buy based on value.

Which is the relationship between their perception of quality and price.

They consider five key factors in buying a home, and I'll show you what those are.”

- “My goal is to help you with a value positioning strategy that will increase your odds from 11% to

potentially 100%.

Would you like to see how it works?”

Step #7:

Use your expertise with MLS photos, descriptions, and Google maps,

to select the top five houses (out of the

16) that a buyer will want to see first.

Again, project yourself into the role of working with a buyer to

pick the best of the 16 houses.

Add the seller's house to the five,

for a total of six houses to compare.

Next you will want to personally visit (or thoroughly evaluate via photos, mls data sheets, etc.)

competing properties.

Buyer's will be doing this, and you want to position your seller's house for the market using “Buyer Eyes”.

You may want to consider taking the seller on the tour of the competition.

As you tour the competition, rate the seller's house on a one to six scales,

with one being first place and six being last place.

You might rate the seller's house as a “3” on condition but

with some reconditioning and staging, you could get it to a “2”,

which means it would be in second place on condition.

Generally, a seller could improve condition and price, but not location.

With time and money, someone may improve the features and amenities and perhaps even the size.

Again buyers purchase on value, which is their perception of the relationship between these five factors.

For the very analytics out there,

there is NO result where you add values to come up with the answer.

Going through the analysis, you determine the seller's house positioning.

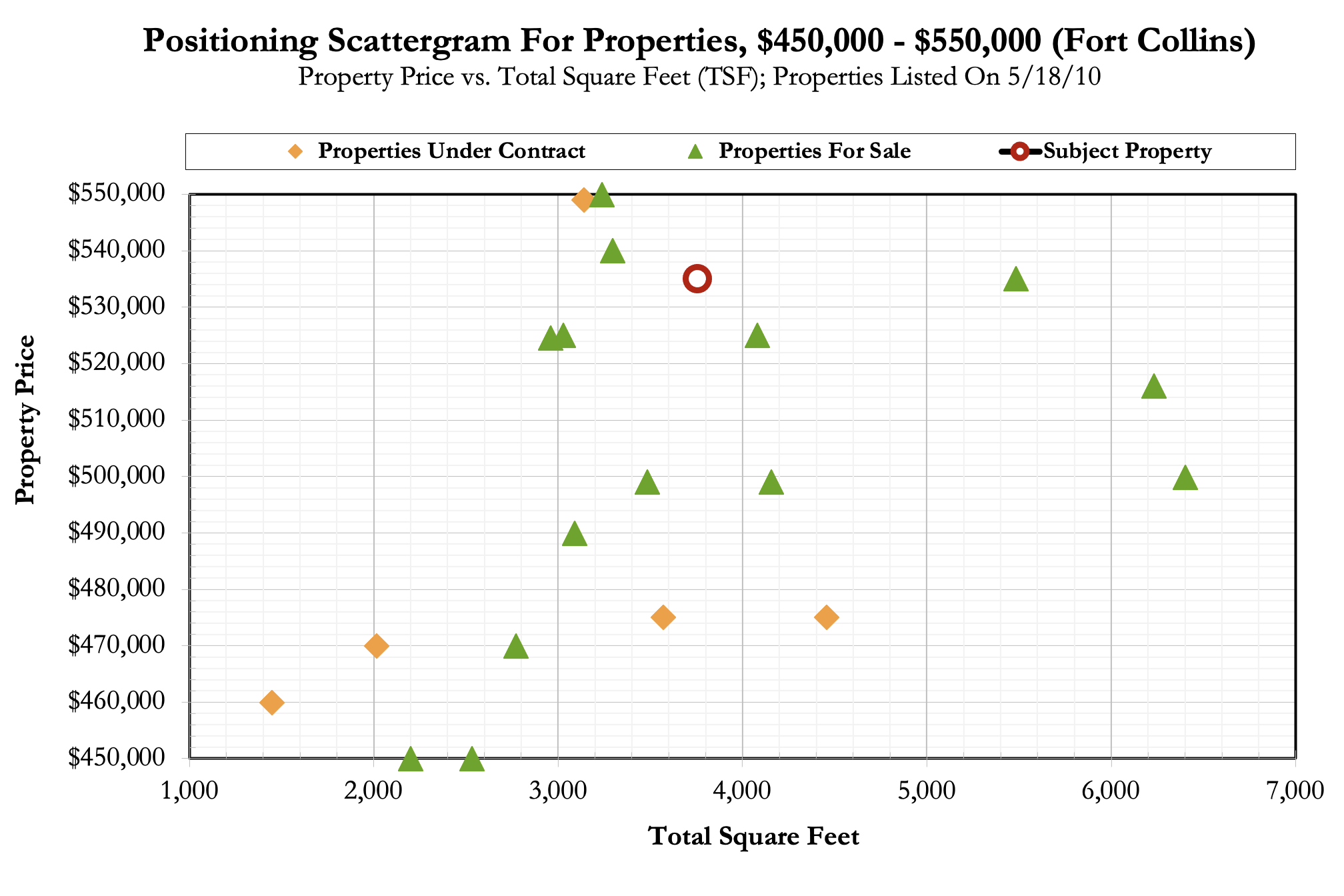

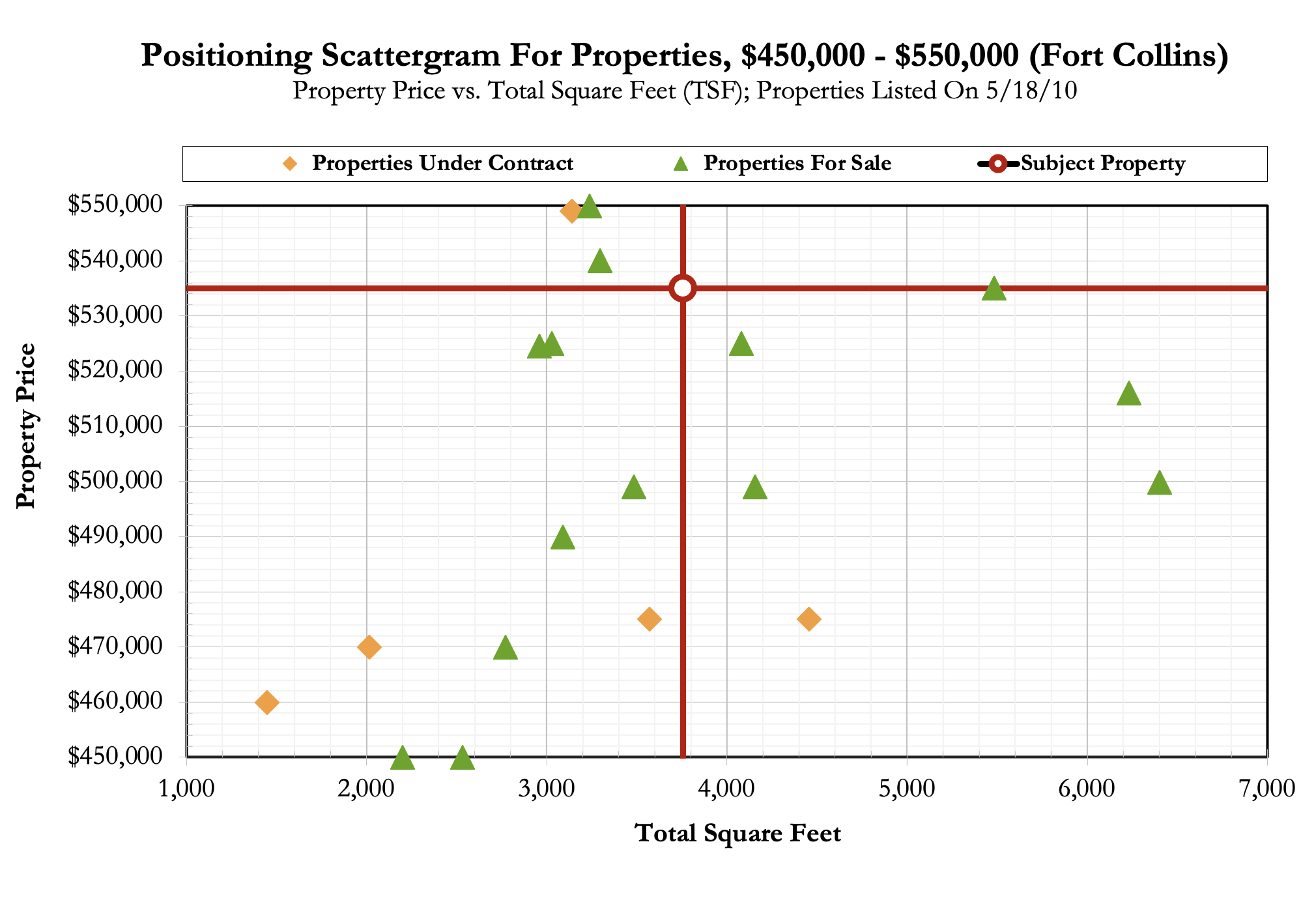

While going through this exercise and rating the homes, as we discussed

is helpful, we believe that the best way to compare properties is to

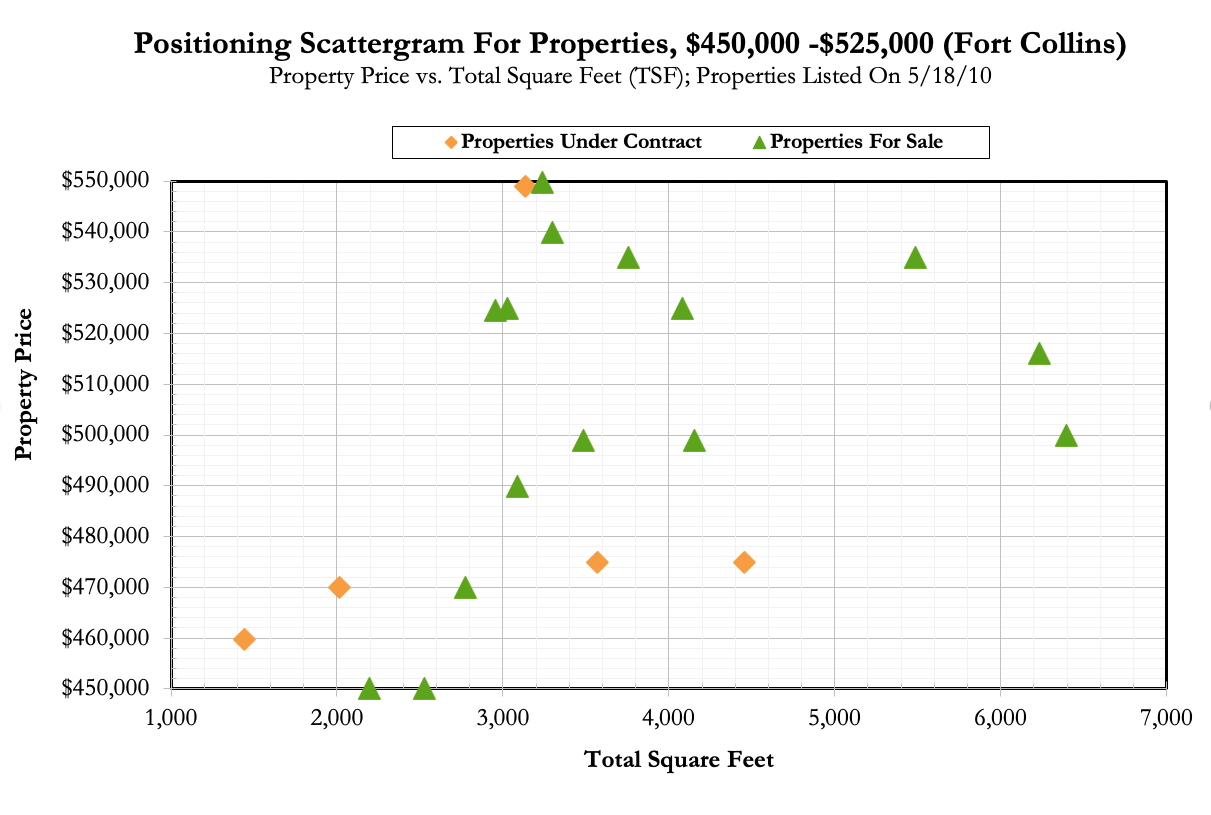

use the

Positioning Scattergram tool.

Step #8:

If the seller wants to be under contract within 30 days,

they need to position their house as the top 1 that a buyer would pick.

If they do this, only one house will sell this month, and they should be that one.

If they are in the top 3,

and 1-2 (1.8 per month) are selling this month; they have a 50% odds of selling, etc.

Remember, markets are very dynamic.

Tracking showings and buyer/Realtor comments is recommended.

We also recommend you re-do your value positioning and absorption rate analysis every two to four weeks.

The above analysis is based on 12 months of data.

If you have a seasonal market or market conditions are changing,

it would be best to do this same analysis using the last three months as a “snapshot” of current market

conditions.

You may discover that the market has slowed (perhaps you need to be in the Top 1 to be under contract in 30

days)

or the market has sped up (and you need to be in the Top 3 to be under contract in 30 days).

The Focus 1st Pricing System does have a configuration parameter

to change the Absorption Rate Period (default is 12 months).

If you have attended a Ninja Installation,

you may recall that it is recommended that you determine the

Absorption

Rate

for 3, 6, and 12-month intervals to determine if the market trend is increasing or declining.

There is a

configuration parameter which will calculate the

Absorption Rate for those three periods for you.

I want to see how to do my positioning search.

I want to see how to do my positioning search.

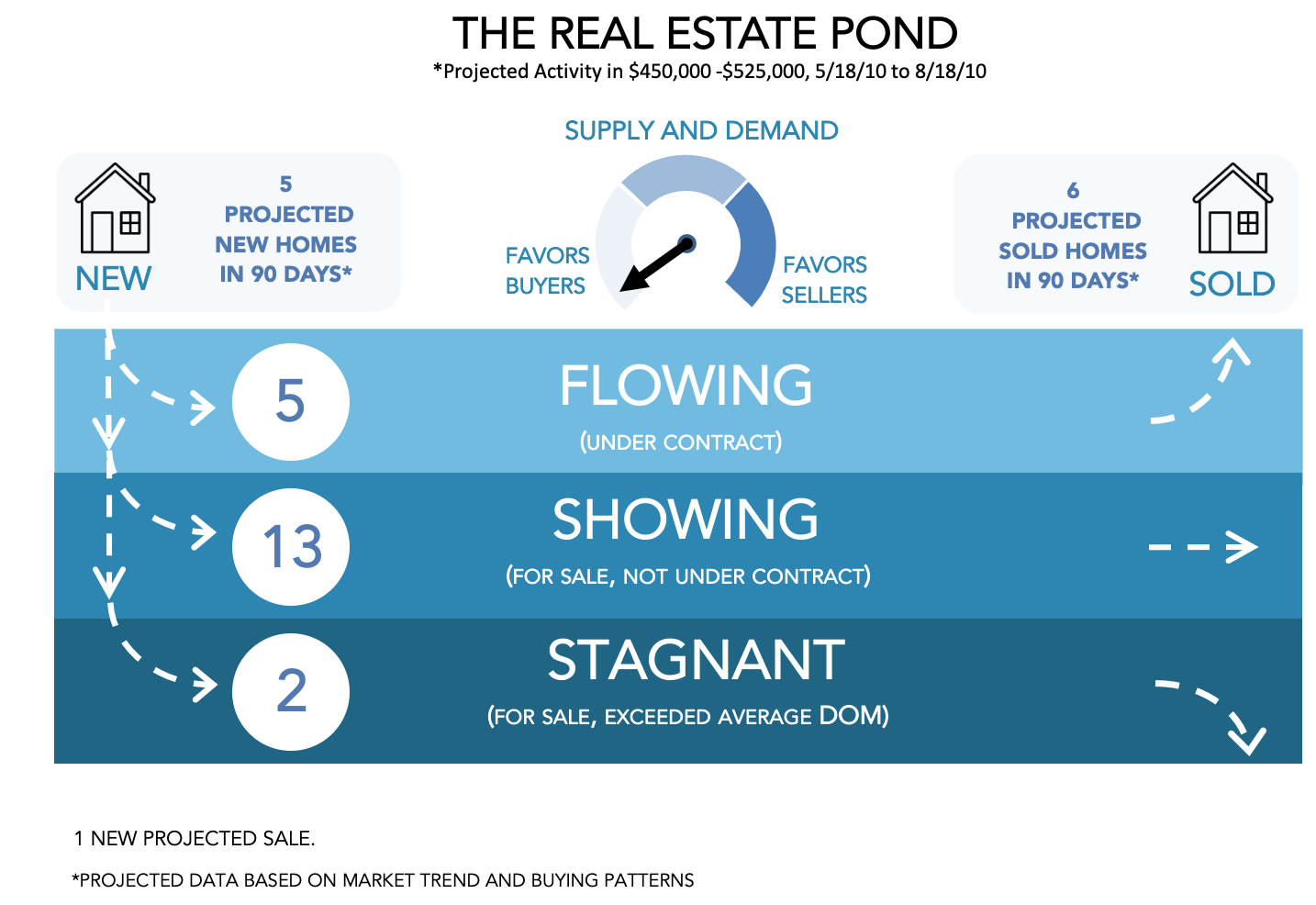

I want to see how the Real Estate Pond works.

I want to see how the Real Estate Pond works.